Juniors: naivety encouragedㅤㅤㅤㅤㅤㅤㅤㅤㅤ

Brazil, and most probably other developing countries, has among its population a naive, enthusiastic and dreamy portion that, under the watch of the global and financial world, is still believing and giving its best energies and savings to projects that mostly end up failing. According to SEBRAE, Brazilian support service for micro and small companies, nearly 80% of small companies do not survive the first 2 years of activity. Although there are exceptions, the few successful Projects, in any field of service, commerce or industry, are “bought” by the major groups, after they have demonstrated success and defeated risks in their neighborhood, community or country.

Something similar happens with dazzled young people who are dedicated to seeking technological innovations for larger companies, which outsource this scientific effort through “open innovation”. The big companies stay only with those researches of their interest, leaving the ideas of little success in the account of the idealism of the “innovator”. The fantasized risk of entrepreneurship is encouraged in all spheres, including through capital offerings.

The small entrepreneur of products or services, in general, does not need a loan (which the global world offers constantly), but needs a local “market” that believes and regularly buys its product or service. This is the point. The same system that encourages the small ones to debt in favor of their dreams, and taking risks, makes it difficult to access of their product or service to the local purchasing market, including through economic actions that reduce the circulation of money and internal consumption, suffocating the small local business activity.

The Outsourcing of Mineral Research

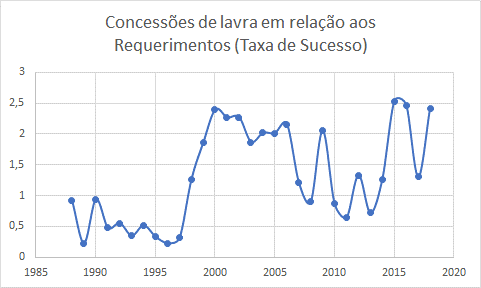

Only 1 to 2% of mineral research activities reach the mining stage. With such a low success rate, although here too there are exceptions, well-established companies within the global economy, normally do not want this risk for themselves, but are always willing to acquire those juniors who have had successful attempts, when everything is fully confirmed.Statistics from the former Departamento Nacional de Produção Mineral – DNPM (National Department of Mineral Production), point out that among 100 research requestings filed, only 1.3 reaches the stage of mining (average from 1988 to 2018).

Although there are exceptions, the junior mining company brings in its core much of naivety; delight for the geology; the pleasure of discovery; the professional option for risk; the desire to make full use of the knowledge acquired; the boldness of youth; perseverance, and constant learning under adversity.

With the idealism encouraged in forums and seminars, juniors are patted on the back, and the “market” offers itself to seek “financial help” (as in recent webinar) and amenities so that juniors can face the risks under better conditions. Tax incentive mechanisms similar to the Rouanet Law (incentive law in the cultural sphere in Brazil) generating tax credits possible to be transferred to the shareholders for income tax reduction. They seek to empower an army of juniors (as a kind of “open mine”) to discover those 1 to 2% of successful research after digging and drilling throughout the national territory.

A junior mining company rarely manages to turn itself into a major mining company, and when it does, it continues to be voraciously observed by the larger ones that buys it at some point in time.

Commercial organizations from Australia and Canada have recently organized similar forums in Chile and Brazil. The same point of origin, financial and global, designs these initiatives in different countries, encouraging the “financing” of the so-called “juniors” in an activity of risk that the large mining companies normally do not want to assume.

So, what’s the suggestion?

The global mining market uses the strategy described above. If world reserves decrease, the price of the commodity goes up and, on the contrary, if new discoveries arise, the tendency will be for the price to fall. So, the global market wants as many reserves as possible, even if they are not immediately extracted.

Mining companies in operation should monitor their own reserves while maintaining a balance between research efforts and the life expectation of their business. Last week it was highlighted the case of Caraíba, which has searched new deposits in nearby regions to keep its Concentrating Plant in operation.

The Brazilian State needs to look at mining as an industrial activity of extraction and processing, generating jobs and forming the basis of the country’s industrial activity. Unfortunately, the State has usually observed mining as if it were a geological research activity followed by ore exploration. The public effort should be driven to open the buying power of the products generated by mining, giving commercial and logistic guarantee to the small entrepreneurs, and encourage the use of these products in national soil, in strategic regions, to promote the verticalization of industry and economy.

We conclude

The “junior” mining company is the gourmet outsourcing of mineral research work, where hundreds of “Indiana Jones” type researchers come out of Brazil willing to take risks. The best discovered mineral deposits are then normally acquired by the big global mining companies, with little work and extreme low risk.

Alexis Yovanovic